-

01 WE MADE FOR

01 WE MADE FOR

- 02 ABOUT US

- 03 WHAT CAN WE DO

03 WHAT CAN WE DO

- 04 LOOKING FORWARD

04 LOOKING FORWARD

THE HIDDEN

CHAMPION BEHIND

CHAMPION BEHIND

THE HIGH-TECH

INDUSTRY

THE HIGH-TECH

INDUSTRY

TSSTechnical Service

Station

EPZExport Process

Zone

FTZFree Trade

Zone

CBZComprehensive

Bonded Zone

BLPBonded Logistic

Park

CSWCustoms Supervised

Warehouse

BLCBonded

Logistic

Center

NBWNon Bonded

Warehouse

CONSIGNMENT REPAIR BONDED WAREHOUSE /TSS

COMPREHENSIVE BONDED ZONE BONDED WAREHOUSE /CBZ

BONDED LOGISTICS CENTER TYPE B BONDED WAREHOUSE /BLC /BLC

PROCESS CONTROL MANAGEMENT

CONSIGNMENT REPAIR SPARE PARTS MANAGEMENT SERVICE

VENDOR MANAGED INVENTORY MANAGEMENT SERVICE

CUSTOMS DECLARATION SERVICE

INTERNATIONAL & DOMESTIC FREIGHT FORWARDER

TRADE AGENTS

CUSTOMER-SPECIFIC CUSTOMIZED SERVICES

PROFESSIONAL INTERPRETATION AND CONSULTING SERVICES

PRE-CLASSIFICATION SERVICE

COMPLETE LOGISTICS SUPPORT SERVICE

A Swiss manufacturer of semiconductor production equipment engaged in providing domestic semiconductor manufacturers with semiconductor equipment installation, commissioning, maintenance and related technical services. Some of the spare parts imported by the company involve the need for compulsory product certification (3C certification), and the customs must verify the 3C certificate before entry. The company was once troubled by the limitation of the preparation of 3C application materials and the time period for processing.

Our company give full play to the policy advantages of our consignment maintenance warehouse, combined with the relevant policies of CNCA for exemption from compulsory product certification, to provide solutions for overseas customers, which not only meets the requirements of customers for high timeliness of customs clearance, but also meets the customs supervision requirements for the supervision conditions of inbound products.

A foreign-invested enterprise in Wuxi, located in Wuxi High-tech Development Zone. The company is an independent branch in the United States, and its main products are: sensor modules, vehicle and aircraft navigation systems, instrumentation, etc. In June 2017, the company placed a verification order with an American supplier for the verification of the company’s original equipment. The original supplier’s name is: Acutronic, which is a low-speed turntable (hereinafter referred to as: turntable). According to the National Metrology Technical Specification No. JJF1210-2008, the spec for the turntable Accuracy arc sec is ± 30, only only the equipment provided by the original supplier can verify the company’s turntable and adjust the off-axis of the turntable. The main verification criteria are ten items such as levelness and orthogonality.

A semiconductor company in Xi’an, mainly producing high-grade memory chips. Located in the bonded zone, the import and export of production equipment and materials, etc. need to be declared to the customs.

The goods and materials of the customer’s suppliers are stored in our bonded warehouse after customs declaration, and delivery can be arranged when the customer has demand.

An integrated circuit manufacturing company in Xiamen, engaged in the manufacture of cutting-edge integrated circuit chips. The company’s production equipment and raw materials are of high value and almost all of them are imported. At the same time, a large number of spare parts are needed for replacement in the daily production process due to equipment maintenance, which requires tens of millions of dollars worth of spare parts consumption every year.

We assist the company to make full use of the national encouragement policy, combined with tariff planning expertise, to maximize tariff reduction and exemption of the import goods, and reduce import costs.

The major semiconductor suppliers set up safety stocks to meet the needs of semiconductor manufacturers in different regions, which can result in great capital pressure on goods, high logistics costs, and have to maintain high inventories and occupy a large amount of funds to ensure the normal operation of the end-user production line.

With the expansion of the semiconductor market in China, the semiconductor manufacturers have very high requirements for the timeliness of goods, which requires that delivery on time according to the order demand to ensure the normal operation of the production line. The major semiconductor suppliers set up safety stocks to meet the needs of semiconductor manufacturers in different regions, which can result in great capital pressure on goods, high logistics costs, and have to maintain high inventories and occupy a large amount of funds to ensure the normal operation of the end-user production line. In 2018, the Customs unified the supervision system of each special supervisory area across the country (Golden Customs II), and each special supervisory area in the country can realize the free circulation of goods without system restrictions. According to the advantages of this system and the customer’s inventory management needs, our company proposes to transfer the goods of each bonded warehouse nationwide to improve the circulation rate of goods, timely meet the demand for goods in different regions of the country and reduce the financial pressure on goods. The outstanding advantages of this solution: semiconductor suppliers can transfer goods in the shortest possible time, to avoid the long time limit for direct procurement from overseas, and the situation that the time for arrival cannot be guaranteed when encountering urgent demand for goods. If the supplier has safety stock in other areas of the country, they can start to transfer goods, which greatly increases the flow of goods, improves the rate of goods circulation, accurately realizes door-to-door service and rapidly links to the semiconductor supply chain.

There is no need to transfer goods from overseas warehouses, and no need to keep too much inventory. It can be transferred from the national warehouses, which improves the circulation rate of goods. It greatly saves time cost and solves the problem of timely response of inventory.

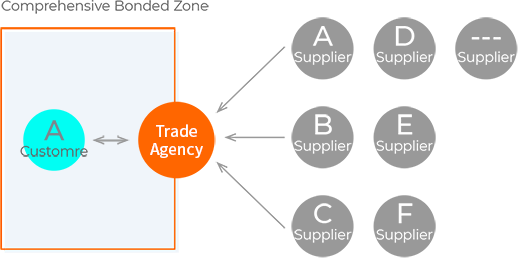

Enterprise A is a large-scale processing trade enterprise in the comprehensive bonded zone, with its production equipment and raw materials mainly imported from abroad. With the rapid development of the enterprise, some auxiliary equipment for production and raw materials are also purchased from China. After several years of development, there are more than 100 domestic production and trade suppliers, accounting for more than 50% of the enterprise’s purchase in the currency of RMB, which brings great challenges to the enterprise’s procurement management and logistics management.

In order to meet the customer’s needs of reducing procurement costs and improving management efficiency, we designed a domestic procurement trade agency program for processing trade enterprises, where Enterprise A obtains the initial quotation from domestic suppliers and sends it to the procurement trade agent, who then pre-classifies the goods according to the detailed cargo information in the quotation. The purchasing trade agent should add customs declaration fees, transportation fees, and tax refund agency service fees according to the initial quotation of Enterprise A’s suppliers, and then deduct the tax refund amount to offer the final quotation to Enterprise A. The final quotation of the trade agent = the initial quotation of the domestic supplier of customer A + logistics fee, service fee for tax refund business - sales discount.

By designing logistics solutions for customers as domestic procurement and trading agents, it not only help customers reduce procurement costs, but also reduce the number of docked suppliers and greatly improve the management efficiency of enterprises.

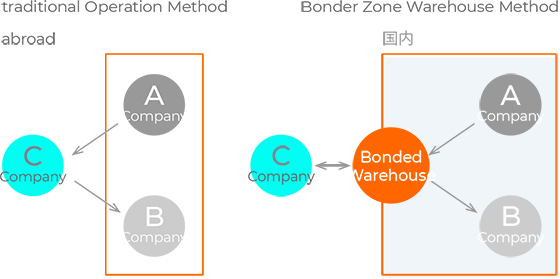

Company C is a multinational company registered in the United States, responsible for global procurement and sales business. It plans to purchase a batch of materials from China’s supplier Company A, and then sell to China’s customer Company B. According to the business flow, the goods must first be sent from Company A to Company C in the United States, and then sent to China’s customer Company B, which is a long cycle and has high logistics costs.

VR solves this problem through the bonded warehousing model, which not only helps customers reduce logistics costs, but also shortens the delivery cycle.

After the equipment completed the last round of competition events in countries such as India and Singapore, it will be transported by sea and air to China to participate in the new round of competitions.

When the RHL Team receives the entrustment of the customer, it first confirms whether the ATA Carnet meets the requirements of China Customs. After the goods arrive at the port, in addition to the normal customs clearance procedures, we also remind customers that the Chinese customs generally give the goods under the import carnet a 6-month re-export period. If the goods are re-exported without customs permission, the Chinese customs will levy full import duties. China Customs allows the re-export of goods under the import carnet in batches, but does not accept batch imports.

After the competition, we will arrange equipment to travel to the next event host country. If the carnet is lost or damaged, we will contact the visa agency of the country that issued the carnet in time to apply for a supplementary carnet. When declaring temporary export to the customs at the importing place with the ATA carnet, the customs will add the export declaration number on the ATA book and stamp the export release seal. Finally, after the goods are shipped normally, the ATA Carnet will be returned to the customer.

Domestic export of spare parts to BLP, BLP transit to TSS, U-TURN

When RHL receives the customer's entrustment, it needs to confirm the corresponding pick-up factory with the supplier in advance, and then arrange the delivery vehicle to pick up the goods at the specified time, and open the box to check the SN number of the goods when they are put into storage. We provide timely feedback to customers at every point of the operation.